Benefits of

EuroDIEM

EuroDIEM delivers significant advantages to all stakeholders in the insurance ecosystem, from carriers and risk transferors to brokers and the wider European economy.

Expand Capacity and Reduce Capital Requirements

Insurance carriers benefit from EuroDIEM through enhanced risk diversification, reduced capital requirements, and access to new markets.

✓ Access to a wider range of risks for portfolio diversification

✓ Reduced capital requirements through risk sharing

✓ Enhanced data insights through the data sharing module

✓ Opportunity (ca. € 200 bn premium) to enter new markets and risk categories

✓ Improved risk assessment through collective intelligence

Lower Premiums and Broader Coverage

SMEs, corporates, and other risk transferors benefit from more affordable insurance and access to coverage for previously uninsurable risks.

✓ Lower premiums primarily due to reduced cost of capital

✓ Increased access to coverage for previously uninsurable risks

✓ Simplified access to a wider range of insurance providers

✓ Resulting expected increase in demand leading to a further expected decrease in premium in due time: higher prevention, better data with the sharing module and lower costs

✓ Enhanced ability to place complex and unconventional risks

✓ Access to a wider range of carriers and capacity

✓ Streamlined processes through technology integration

✓ Value-added services through data insights and analytics

✓ Improved client satisfaction

through better risk solutions and lower premium

Enhanced Placement Capabilities

Brokers play a central and supportive role in the EuroDIEM platform, benefiting from enhanced capabilities to serve their clients and a significant development opportunity (ca. € 200 bn premium):

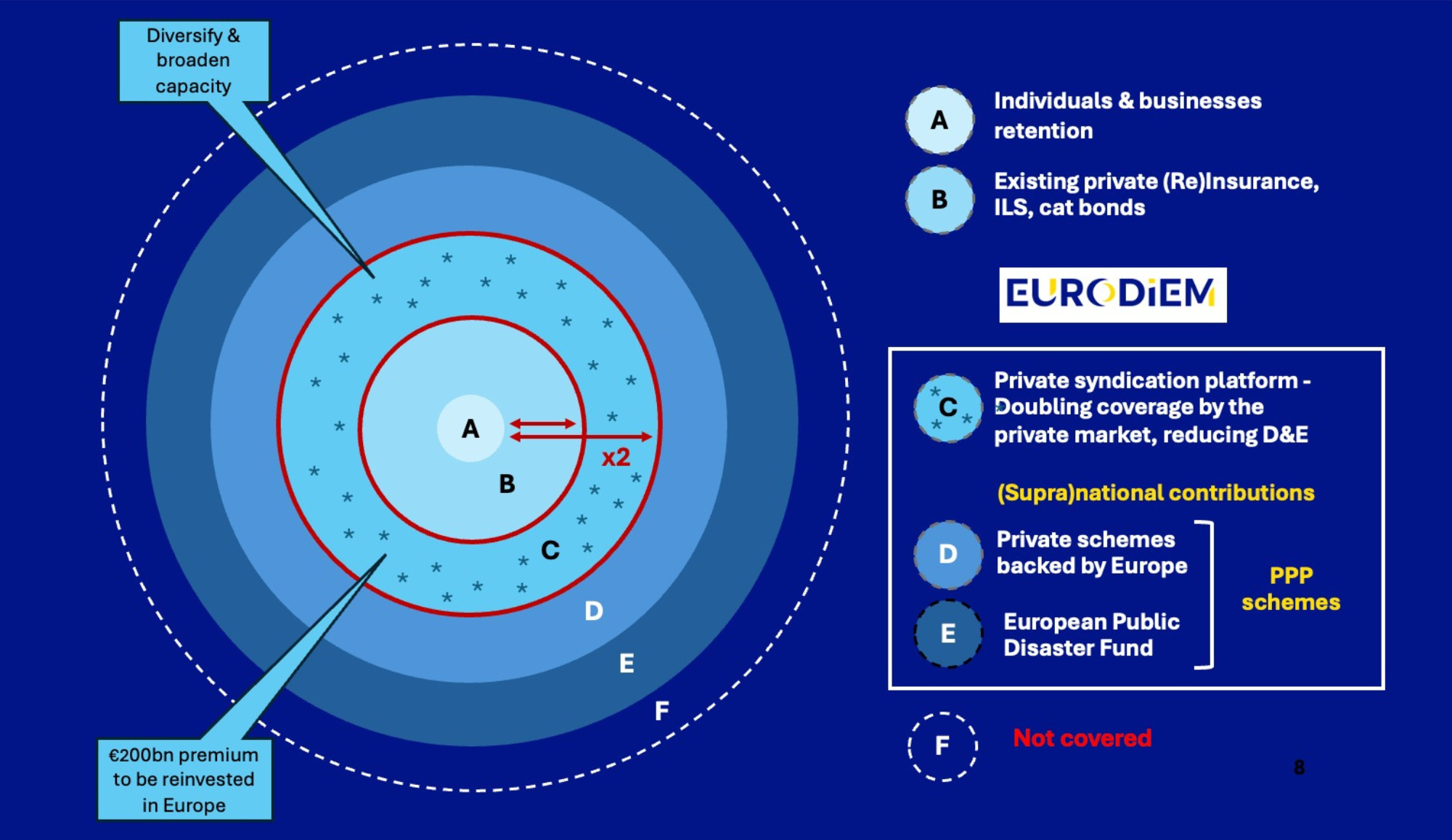

Reducing the Protection Gap

EuroDIEM contributes significantly to the European economy by reducing the protection gap and supporting EU priorities.

✓ Reduced protection gap, estimated at €200 billion annually

✓ Decreased national and supranational debt burden

✓ Support for large industrial innovative projects

✓ Transformation of savings into investments in European priorities

✓ Enhanced European resilience to catastrophic events

Use Cases

Explore how EuroDIEM can address various insurance challenges across different sectors.

Natural Catastrophe Coverage

Enabling more affordable and accessible coverage for natural disasters like floods, earthquakes, and wildfires through efficient risk syndication.

Cyber Risk Protection

Addressing the growing cyber threat landscape by providing more capacity and expertise for this rapidly evolving risk category.

Emerging Technology Risks

Supporting innovation by providing insurance solutions for new technologies like carbon capture, automative softwares, and other emerging risks.

Join Us in Transforming Insurance

EuroDIEM is at a pivotal moment with an incredible alignment of factors making this the perfect time to launch our platform. Be part of this transformative journey.